House Upgrades Tax Deductible

For more details on home office write-offs consult IRS Publication 587. Through the 2020 tax year the federal government offers the Nonbusiness Energy Property Credit.

This is because an improvement adds value to your property for.

House upgrades tax deductible. 7031 Koll Center Pkwy Pleasanton CA 94566. Once you make a home improvement like putting in central air conditioning installing a sun-room or upgrading the roof you are not able to deduct. Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs.

Youll add the cost to the basis of the property to which the improvements were made. These are assessed annually and typically paid on. How to Deduct Improvements on Your Taxes You can deduct improvements made on your property however you cannot deduct the full value of the improvement in the year the improvement occurred.

Business Use of Your Home. As you know your home is subject to local property taxes. Upgrades typically increase the value of your home -- creating equity for you -- but they generally dont grant tax savings.

There are many strategies to use house remodeling and upgrades to reduce your taxes. Each year the department calculates effective tax rates based on tax reduction factors that eliminate the effect of a change in the valuation of existing real property on certain voted taxes. For example if youve added a septic system or a water filtration system these would qualify.

However there are many techniques that you can utilize for home remodeling and upgrades to decrease your taxes. Remodeling of your house is not usually a cost that can be deducted from your federal income taxes. However there are two instances in which you may qualify for a.

But if you keep track of those expenses they may help you reduce your taxes in the year you sell your house. Under Americas current federal tax code home improvements are generally not tax deductible. Youll want to use IRS Form 4562 to determine your deduction for depreciation and amortization.

When you make a home improvement such as installing central air conditioning or replacing the roof you cant deduct the cost in the year you spend the money. For example through the homestead exemption a home with a market. This is because they benefit the property over time by adding lasting value.

For a 2000 square foot office thats a 1000 deduction. Hiogov 105 Tax reduction factors. The IRS treats your home as personal property and other than the.

Any improvements made to your house that increase the resale value are tax deductible but not only in the year theyre made. Keep your taxes in mind and plan ahead before renovating your rental property. Receiving a property tax bill for your Ohio home is almost as painful as watching the Wolverines trounce the Buckeyes.

For the 2020 tax year just multiply 5 by the area of your home. The answer could be yes or no. Examples of this type of improvement include permanent additions installing a security system adding in a swimming pool or major landscaping.

The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021. Attach this form to your tax return for the year in which you are claiming the deduction. Heres an overview of how home improvements can affect your taxes.

Note that this deduction is limited to 300 square feet. The exemption which takes the form of a credit on property tax bills allows qualifying homeowners to exempt up to 25000 of the market value of their homes from all local property taxes. Property Tax Real Property.

Either way you will need to track your expenses for any home improvement. The entire cost of a repair is deductible in a single year while the cost of an improvement to the rental property may have to be depreciated over as much as 275 years. Any upgrades youve made to your homes plumbing system qualify as a deductible home improvement.

Pin On Top Real Estate Articles

Mortgage Refinance Tax Deductions Turbotax Tax Tips Videos

What Home Improvements Are Tax Deductible

Are Roof Repairs Tax Deductible B M Roofing Colorado

Make Sure To Take These Home Improvement Tax Deductions For 2016

Making Your Home Energy Efficient Is Tax Deductible Finerpoints Accounting

Are Home Improvements Tax Deductible Lendingtree

What Home Improvements Are Tax Deductible Reliable Home Improvement

Tax Deductible Home Improvements Repairs For 2021 Walletgenius

5 Tax Deductions When Selling A Home Did You Take Them All

Home Equity Loans Can Be Tax Deductible Nextadvisor With Time

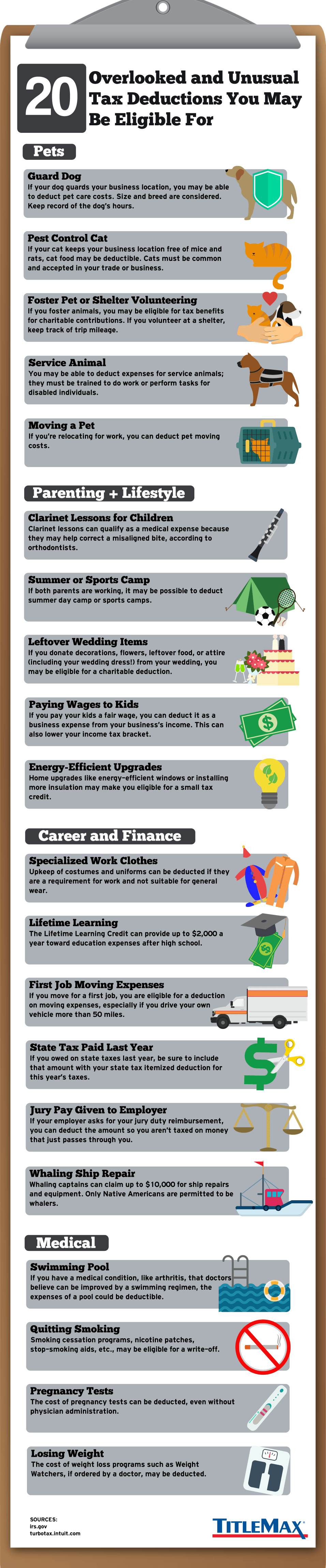

20 Overlooked And Unusual Tax Deductions You May Be Eligible For Titlemax

Can You Claim Tax Breaks For Capital Improvements On Your Home Home Improvement Grants Home Buying Homeowner

Tax Deductible Home Improvements Tax Deductions Home Improvement Improve

Are Home Improvements Tax Deductible Rayne Water

Tax Deductions For Vacation Homes Depend On How Often You Use It

Tax Deductible Home Improvements Granite Transformations Blog

Buying A Second Home Tax Tips For Homeowners Turbotax Tax Tips Videos

Tax Breaks For Capital Improvements On Your Home Houselogic

Post a Comment for "House Upgrades Tax Deductible"