House Taxes By Zip Code

Contact a property tax professional. It has the fifth-highest property taxes in the entire state with an average effective rate of 210.

California Property Tax Calendar Property Tax Home Ownership July 1

Keep in mind that sales tax jurisdiction rules can sometimes be too complicated to.

House taxes by zip code. Just enter the ZIP code of the location in which the purchase is made. 57 of the 43137 zip code residents lived in the same house 5 years ago. Property taxes are higher in Fort Worth than in Arlington.

One mill is equal to 1 of tax for every 1000 in assessed value. Out of people who lived in different counties 50 lived in Ohio. Tarrant County sits west of Dallas and contains the cities of Fort Worth and Arlington.

Home Appreciation in Westerville zip 43082 is up 40. Property tax rates in Ohio are expressed as millage rates. Home appreciation the last 10 years has been 303.

January February March April May June July August September October November December 2021 2020 2019 2018 2017. The median home value in Tarrant County is 170300. Out of people who lived in different houses 86 lived in this county.

And remember property taxes vary from county to county and. 78 of the 43203 zip code residents lived in the same house 1 year ago. You can search properties by address and zip code to find home values tax data and other relevant information.

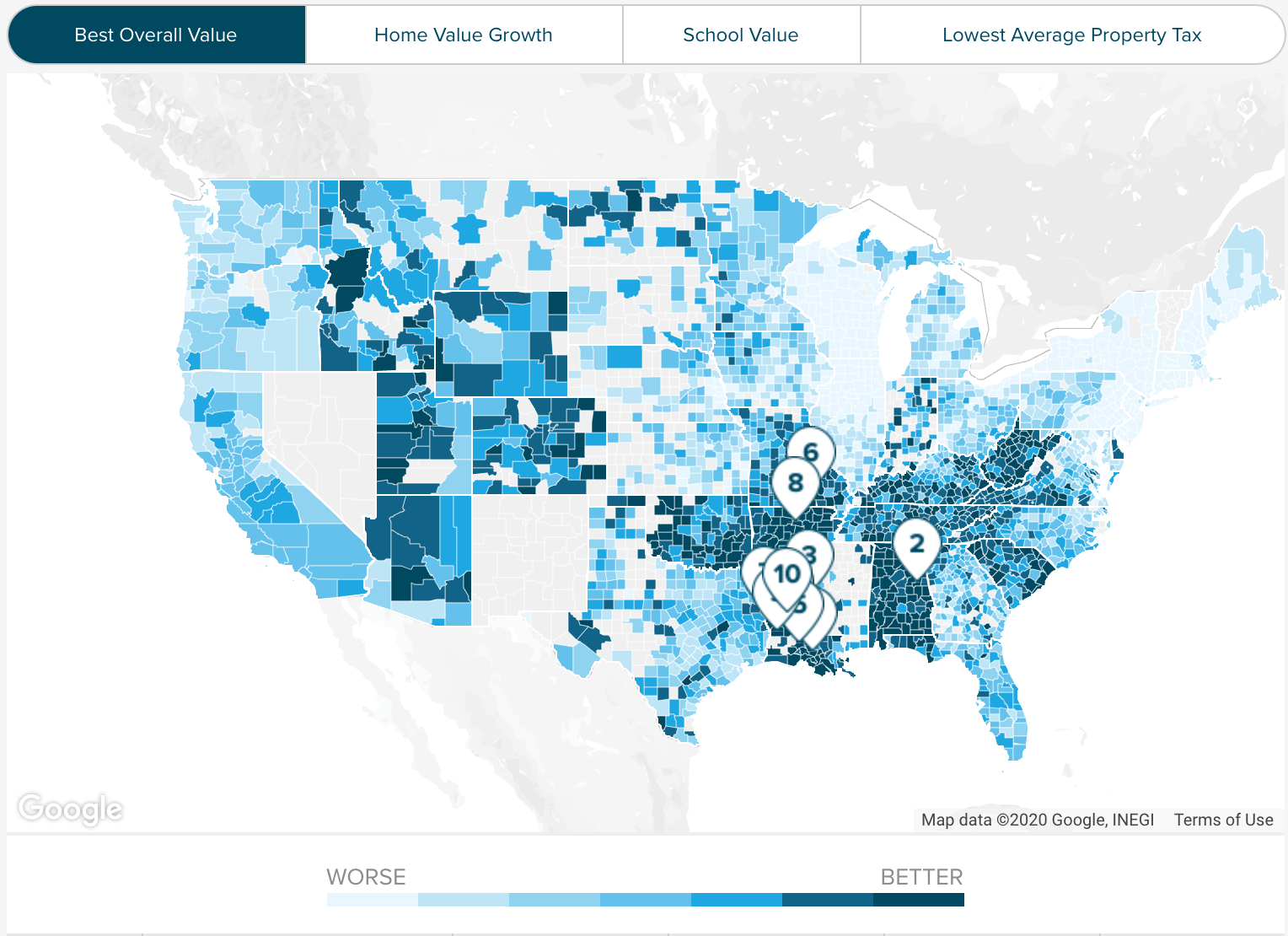

Lookup By Zip Code. The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of. Overall homeowners pay the most property taxes in New Jersey which has some of the highest effective tax rates in the country.

Individual Income Tax ZIP Code Data. The amount of a particular propertys tax bill is determined by two things. Ohio Property Tax Rates.

Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year. Out of people who lived in different houses 55 moved from this. That may sound low but Tarrant County property owners pay a relatively hefty median real estate tax amount of 3581.

Out of people who lived in different houses 80 moved from this. Tarrant County Property Tax Rates Photo credit. The data include items such as.

That makes the average effective property tax rate in Tarrant County quite high at 210. Home Appreciation in Columbus zip 43228 is up 30. Average Age of Homes - The median age of Westerville zip 43082 real estate is 18 years old The Rental Market in Westerville zip.

Out of people who lived in different counties 50 lived in Ohio. Property taxes are an important tool to help finance state and local governments. Because of the differences in assessed value described above millage rates in one county cannot be directly compared to another.

Property Shark is another useful website for figuring out your homes property taxes. In that same year property taxes accounted for 46 percent of localities revenue from their own sources and 27 percent of overall local. Again there is no comprehensive platform for finding current property taxes by zip code.

The tax rate is determined by the amount of the tax levy to be raised from all or part of an assessing unit and the units total taxable assessed value. 47 of the 43203 zip code residents lived in the same house 5 years ago. ZIP Code data show selected income and tax items classified by State ZIP Code and size of adjusted gross income.

Average Age of Homes - The median age of Columbus zip 43228 real estate is 37 years old The Rental Market in Columbus zip. 19 of the 43210 zip code residents lived in the same house 5 years ago. Out of people who lived in different houses 38 moved from this.

Out of people who lived in different counties 50 lived in Ohio. 72 of the 43210 zip code residents lived in the same house 1 year ago. Out of people who lived in different houses 12 lived in this county.

The median home cost in Westerville zip 43082 is 336600. Data are based on individual income tax returns filed with the IRS and are available for Tax Years 1998 2001 and 2004 through 2017. Property Taxes by State.

That means that if your home is worth 200000 you could expect to pay about 4200 annually in taxes. If available Zip 4 will provide more accurate results. Rates vary by school district city and county.

Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes collected. The states average effective rate is 242 of a homes value compared to the national average of 107. Home appreciation the last 10 years has been 274.

The median home cost in Columbus zip 43228 is 131500. Out of people who lived in different houses 45 lived in this county. The SalesTaxHandbook Sales Tax Calculator is a free tool that will let you look up sales tax rates and calculate the sales tax owed on a taxable purchase for anywhere in the United States.

The propertys taxable assessment and the tax rates of the taxing jurisdictions in which the property is located. The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. Enter the zip code in which the property is located to estimate your property tax.

In fiscal year 2016 property taxes comprised 315 percent of total state and local tax collections in the United States more than any other source of tax revenue. 88 of the 43137 zip code residents lived in the same house 1 year ago.

Washington Property Tax Calculator Smartasset Com Property Tax Property Washington

Understanding Your Property Tax Bill Department Of Taxes

Texas Property Tax Travis Central Appraisal District

30 N J Towns Highest Property Taxes Buyers Beware While This List Is True You Have To Read The Fine Print T Large Homes National Standards Property Tax

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Understanding Your Property Tax Bill Department Of Taxes

Florida Property Tax H R Block

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Understanding California S Property Taxes

New Hampshire Property Tax Calculator Smartasset

Property Taxes How Does Your County Compare Cnnmoney Com

Median Property Taxes By County Tax Foundation

Secured Property Taxes Treasurer Tax Collector

Arizona Property Tax Calculator Smartasset

Secured Property Taxes Treasurer Tax Collector

Post a Comment for "House Taxes By Zip Code"